Achieve financial freedom by understanding your unique identity. Your standing is a key measurement of your financial well-being. By actively nurturing your credit, you can unlock advantages for financing. A strong identity IQ empowers you to master the financial landscape with assurance.

Achieving the Secrets to a Stellar Credit Score

A stellar credit score is the cornerstone to financial opportunity. It can grant access favorable interest rates on mortgages, influence your ability to acquire insurance, and even influence your employment. Building a strong credit score is an lifelong process that requires discipline.

- Focus on making payments on time, every time.

- Maintain a low credit utilization ratio by spending less than 30% of your available credit.

- Monitor your credit report regularly for inaccuracies and challenge any concerns promptly.

By adopting these practices, you can unlock the power of a stellar credit score and set yourself up for long-term success.

Gain Insight : Get Clarity on Your Financial Health

Your credit history is a key reflection of your overall financial well-being. A strong credit score can unlock {betterfinancial products and make it less challenging to achieve your financial aspirations. However, a challenged credit history can hinder your choices. Regularly checking your credit report is an essential step in evaluating your financial situation and taking control to improve it.

Here are some reasons of conducting a report analysis:

- Uncover potential errors on your credit report

- Track changes in your credit score over time

- Assess the factors that are impacting your credit score

- Create a plan to improve your credit score

By being proactive, you can gain valuable insights.

Protecting Your Digital Footprint: Identity Theft Protection

In today's digital age, our personal details is constantly at danger. Identity theft is a major issue that can severely harm our lives. It's crucial to take steps to secure our digital footprint and minimize the chances of becoming a sufferer.

One step in personal theft prevention is to be alert of the dangers. Understand how criminals may try to steal your private information, more info such as credit card numbers, access codes, and names. With understanding, you can make smarter actions to safeguard yourself.

Implementing strong passwords is essential step in identity theft protection. Refrain from common passwords, and consider a encryption software to create strong, unique passwords for each of your accounts.

Regularly check your financial accounts for any unusual transactions. Communicate with your bank immediately if you discover anything unfamiliar.

Comprehending Your Creditworthiness: IDIQ

Your credit score is a vital reflection of your financial standing. It's used by lenders to determine your liability to repay borrowed funds. A higher credit score typically unlocks more attractive interest rates and loan terms. Understanding the factors that impact your creditworthiness can enable you to improve your financial position.

IDIQ contracts, which are large-scale government contracting agreements, can offer unique challenges for businesses. Navigating the intricacies of these contracts requires a thorough understanding of government procurement processes, regulations, and industry best practices.

- Fundamental factors that influence your creditworthiness include: payment history, credit utilization, length of credit history, credit mix, and new credit.

- Constantly monitoring your credit report is essential for uncovering any potential errors.

- Challenge any incorrect information on your credit report promptly.

Unlock Your Credit Score Now: A Quick and Easy Path to Insights

Your credit score is a vital number that can impact your financial future. Understanding your creditworthiness empowers you to make informed decisions about loans, financing options. Luckily, checking your credit score has never been easier or faster. With a variety of online tools available, you can retrieve your credit report and score in just a few clicks. These platforms often provide detailed information about your credit history, showing strengths and areas for improvement.

By regularly monitoring your credit score, you can stay on top of your financial health. This proactive approach allows you to identify potential issues early on and take steps to boost your credit standing.

Remember, a good credit score can open doors to favorable loan terms.

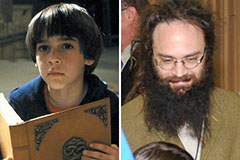

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!